When U.S. companies go into business overseas, it's American workers who get stuck with the bill.

For years now, politicians have been promising to do something about the flight of American jobs overseas. So why does Washington continue to reward companies that invest abroad? That's right, reward. Because our tax code actually encourages companies to do business in places like Mexico, China, and India-which sticks the rest of us with a higher tax bill.

"The U.S. tax code is set up so that if I am a U.S. corporation trying to decide whether to create jobs in Ohio or in Ireland, it will point me toward Ireland," says Martin Sullivan, a contributing editor at Tax Analysts, a nonprofit organization that tracks tax policies worldwide.

Don't believe it? Here's how it works: In theory, the government taxes the worldwide earnings of U.S.-based companies. But under the federal tax code, American companies have to pay taxes only on the earnings of their foreign subsidiaries when they bring that money back to the States. But there's no rule saying those companies ever have to bring that money home. As long as they reinvest their foreign earnings abroad, they pay only the host country's (usually lower) tax rate. That's what you'd call a big, fat loophole, and big business finds a loophole like water finds a leak.

Many companies just plow the money they make overseas back into their foreign operations-things like factories that employ hundreds of workers. That means more economic growth for other countries-and less here at home. As a 2006 report by the nonpartisan Congressional Research Service bluntly put it, this scheme is "an incentive for U.S. firms to invest abroad in countries with low tax rates."

We're talking about dollar figures that will make your head spin. According to a 2006 government report, U.S. companies have nearly $500 billion stashed abroad that could be taxed here at home. A recent USA Today examination of Securities and Exchange Commission records discovered that General Electric had $62 billion stowed overseas; Pfizer, $60 billion; and ExxonMobil, $56 billion. A recent Tax Analysts study discovered that in 2004 alone, U.S.-based multinationals shifted nearly $50 billion in income to countries with lower taxes.

The problem is a tax law that was last updated during the Kennedy administration. During the Cold War, the government did have a good reason to encourage investment abroad: We wanted to extend American influence to combat Communism. No one would write the law this way today. But an army of corporate lobbyists are fighting to keep things just as they are. As Robert McIntyre of the Washington-based tax policy group Citizens for Tax Justice says, "There's no benefit to anybody but the companies that do it."

It's hard to pinpoint just how many jobs our tax code ships overseas. But in an article published by Tax Analysts, Martin Sullivan found that U.S.-based multinational companies are creating about one new job overseas for every one they slash here. The issue isn't just jobs, though. Every dollar of taxes that these companies avoid shifts the burden further onto working folks. With loopholes like this, is it any wonder that the share of overall taxes paid by corporations is less than half what it was when Eisenhower was president? And this at a time when CEOs get rich while the wages of average workers stagnate and everyone gets socked with higher health care and energy costs.

So when you think about it, the really loony part is that American workers are in effect subsidizing-through taxes-their own job losses. What's more maddening is that this isn't a secret. It blows up in the news every couple of years during election season, with politicians vowing to close this loophole in an instant. But once the votes are cast, the talk in Washington dies down.

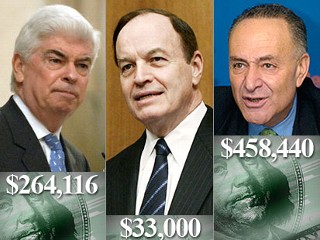

When it comes to overseas earnings, Congress needs to step in and make companies pony up. It could change the law to tax overseas earnings at the same rate as domestic income. That would mean all-out war with powerful lobbyists, who also happen to donate generously to both parties. (Translation: It's not very likely.) Another idea is to lower tax rates across the board for all corporations, making America more competitive abroad and rewarding companies investing here at home-while letting the government reap gains from less tax avoidance. That's not protectionism or big government. It's just applying the law with common sense and fairness.

Defenders of the current situation say that changing the foreign-income law could stunt the economy and drive businesses to relocate more, if not all, of their operations to other countries. But not many American CEOs want to leave their home country altogether-they would rather avoid the unpredictable social and legal factors in foreign countries. Plus, they like living here in the United States. Another claim is that when American companies do well overseas, their profits help them flourish back home, too, creating more jobs everywhere. If people really believe that, then why not just be open about it and create tax credits for investment overseas?

Let's be realistic: Changing the tax code can't stop jobs from going overseas. Profit-minded companies will always seek out places where labor is cheaper, almost regardless of the tax consequences. The huge money a CEO can save by relocating a call center from Indiana to India will often outweigh any other factor. But even though we can't do anything about wages abroad, we can stop Washington from rewarding companies for investing overseas-at the expense of American workers.

![[Loose Money and the Root of the Crisis]](http://s.wsj.net/public/resources/images/ED-AI299_shelto_D_20080929153122.jpg) Corbis

Corbis

If you're older, you can make sure your investment mix is balanced and in-line with your investment plan. For instance,

If you're older, you can make sure your investment mix is balanced and in-line with your investment plan. For instance,  The one thing that you can do, regardless of age, if you're investing in any kind of fund is make sure your expense ratios are low. These are the various fees your fund is charging you to invest it. Typically index funds offer the lowest expense ratios. Expense ratios work like the fund earning compound interest on your money, which, after years, can add up to tens of thousands of dollars less in your pocket. (see our post "

The one thing that you can do, regardless of age, if you're investing in any kind of fund is make sure your expense ratios are low. These are the various fees your fund is charging you to invest it. Typically index funds offer the lowest expense ratios. Expense ratios work like the fund earning compound interest on your money, which, after years, can add up to tens of thousands of dollars less in your pocket. (see our post " If this sounds like the same stuff you always hear, that's because it is. The point of that same old stuff is that you make a solid long-term plan and you stick with it, whether times are good, bad, or apocalyptic. Now, as ever, timing the market is unwise. Dollar-cost-averaging,

If this sounds like the same stuff you always hear, that's because it is. The point of that same old stuff is that you make a solid long-term plan and you stick with it, whether times are good, bad, or apocalyptic. Now, as ever, timing the market is unwise. Dollar-cost-averaging,