INVESTMENT THESIS

- Strong worldwide demand for implementing solar energy technology is driving demand for silicon solar cells. BTUI equipment is used in three stages of manufacturing silicon solar panels. The solar industry is expected to grow 30% for the next several years.

- Silicon solar cell manufacturers are switching from batch manufacturing to inline processes to lower the cost per watt produced. This creates strong demand for BTUI products.

- Manufacturing in China has improved the company’s margins. Engineering and service in Shanghai enables solar manufacturers to test processes and equipment when designing a manufacturing process.

- The electronics business is rebounding from a very weak 2007. Technology from electronics is transferable to the solar business. Electronics provides manufacturing and support infrastructure for growth in solar.

RISKS

- Government subsidies for implementing solar panel technology are supporting demand for solar panels. These subsidies are subject to change.

- Solar cell manufacturers may not embrace in-line manufacturing.

- A significant decline in oil prices may cause a decline in demand for implementing solar energy solutions.

click to enlarge images

BUSINESS OVERVIEW

BTU International (BTUI) designs and manufacturers thermal processing equipment used to manufacture electronic printed circuit boards (PCB) and solar cells, and for processing nuclear fuel. The company’s legacy Electronic business makes reflow furnaces that are used for PCB assembly and semiconductor packaging. The growth story for BTUI is the application of the company’s technology in manufacturing silicon solar cells, the highest volume photovoltaic (PV) technology in use today. The company also has a product for thin film solar cells and is working with leading technology developers to design equipment for this emerging market. In both the solar and electronics markets, BTUI products lower manufacturing costs for in-line high volume production. There is tremendous opportunity in the solar cell market since most manufacturers use batch processing, and growth in solar panel demand is driving the implementation in-line manufacturing processes to lower the cost per watt.

Printed circuit boards are in most electronic devices such as mobile phones, PDA’s, GPS equipment, flat screen TVs, desktop and laptop computers, MP3 players, household appliances and automobile electronic control systems. A critical step in manufacturing printed circuit boards is the solder reflow process when electrical connections are completed. This solder reflow or surface mount process requires accurate temperature control for high throughput and high yields. The company’s reflow furnaces create a precise temperature and atmosphere environment to ensure soldering without damaging electronic components attached to the board. When the atmosphere must be oxygen free, nitrogen or other gases are used in the furnace. The semiconductor packaging process also requires precise temperature control in using deposited solder to allow integrated circuits to bond to the substrate board and other electronic components.

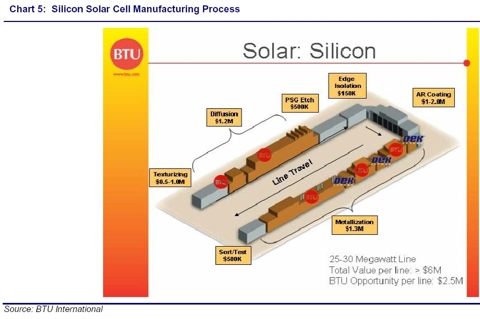

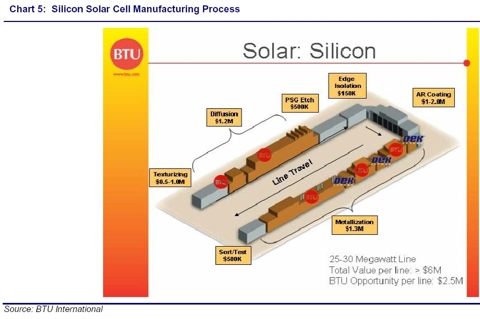

The Alternative Energy business unit is primarily focused on the solar cell manufacturing market, but also makes industrial furnaces for the nuclear fuel market and is designing products for the fuel cell market. Manufacturing silicon solar cells and printed circuit boards have similar requirements for precise high temperature control. There are several steps in manufacturing photovoltaic (

PV) solar panels that utilize BTU International products. The company’s In-Line Diffusion systems create a precise high temperature environment for the deposition of phosphorous vapor onto a silicon substrate. In the Metallization process, where thick film conductive links are applied, accurate high temperature requirements are achieved by infrared lamp furnaces. BTUI furnaces may also be used when applying the anti-reflective coating on a solar cell, which helps to entrap the light into the cell.

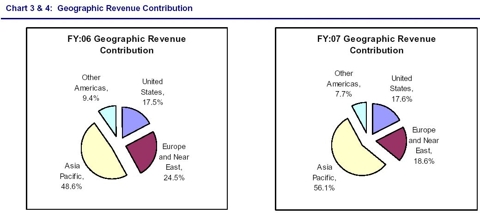

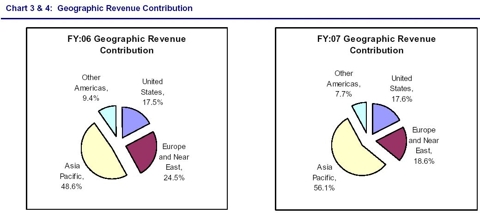

For the nuclear fuel market, the company’s high temperature furnaces are used to process nuclear fuel pellets for use in nuclear reactors. BTUI furnace technology has applications in manufacturing fuel cells and the company is working with developers of solid oxide fuel cells to create low cost manufacturing processes. The company does not identify market segments in its SEC filings, but indicates that revenues from the Alternative Energy business was 21% of total in FY:07, driven primarily by solar cell manufacturers. In the Electronics business, contract manufacturers for printed circuit boards are the largest customer group. The geographic breakout of revenues is shown below.

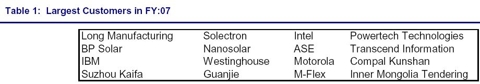

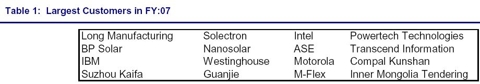

The concentration of revenues from Asia/Pacific is due to the concentration of PCB and solar cell manufacturers in the region. The Chinese share of both the PCB and solar cell manufacturing markets is growing. The company’s world class in-line continuous process furnaces serve many large PCB manufacturers and some of the largest silicon solar cell manufacturers as shown in the table of customers. The company’s products lower product waste due to precise uniform temperature control, and can be configured to meet customer specifications. No one customer accounted for more than 10% of revenues.

The Company’s principal manufacturing, systems integration and testing facility is in North Billerica, Massachusetts. In 2004, BTU International established an engineering and manufacturing facility in Shanghai, China, which is instrumental in serving the growing solar customer base in the Asia/Pacific region. BTUI markets its products primarily through a direct sales force.

Weakness in the Electronics business in 2007, partly offset by strong demand from solar cell manufacturers, caused revenues to decline 18.6%. Market growth and competition among PV solar cell manufacturers is driving implementation of lower cost manufacturing processes. BTUI in-line furnaces lower the cost per watt of silicon solar cells. The company’s investment in engineering and servicing of solar cell manufacturers will continue in 2008. Several new products for silicon solar cell manufacturing were introduced in the past year and new products for thin film solar applications are scheduled for late 2008. We believe high energy prices will continue to support implementation of solar panels worldwide. In the Electronics business, we expect revenues to rebound from the dismal FY:07. We initiate coverage of BTUI with a BUY rating and a price target of $20.00.

ALTERNATIVE ENERGY MARKETS DRIVE GROWTH

Solar panel manufacturers are moving from batch to in-line processing. Approximately 80% to 90% of existing worldwide silicon solar panel production is manufactured with batch processes, according to the company. As the PV solar panel market grows, competition among manufacturers is driving the adoption of more efficient in-line processes to lower costs. All BTUI products are designed for in-line continual processing. The company estimates that approximately 50% of PV manufacturing will convert to in-line processing within the next two to three years. As manufacturing costs decline, we expect lower PV prices to fuel demand for solar panels.

Solar panel production expected to grow 30% annually. The solar panel manufacturing industry has grown 40% to 60% annually in the past few years. Solarbuzz, a solar industry research firm, reports that total wattage of photovoltaic panel installations grew 62% worldwide in 2007. According to BCC Research, PV installations are expected to increase at a compound annual rate of 30% from 2008 through 2013. Both research firms identify the high price of crude oil and electricity along with global demand for renewable energy sources as the primary drivers for growth in PV solar panels.

BTUI has the technological expertise for solar panel manufacturing. The company is applying its technological expertise achieved in the electronic markets to improve the manufacturing process for photovoltaic solar cells. According to Solarbuzz, silicon solar cells constitute 88% of the PV solar cell market. To meet growing demand and lower production costs, the PV manufacturing industry is focused on reducing waste, and improving efficiencies and throughput. The BTUI product line focuses on two main components of silicon solar cell manufacturing, In-Line Diffusion and Metallization. In Q1:08, the company reported strong demand for the Metallization furnaces. The company also has Anti-Reflective Coating products, but is placing less emphasis here.

The company’s In-Line Diffusion products couple phosphorous doping (spraying) of silicon wafers with a quartz lined continuous furnace. The TFQ series product line operates at 850 to 900 degrees Celsius, and can be configured for up to 1,500 silicon wafers per hour. The in-line system decreases wafer handling and improves throughput as compared to batch processing.

In the Metallization process, thick films of aluminum and/or silver are applied to both sides of the solar cell. These conductive materials will be either screen printed or spot printed on to the silicon wafer. After drying, subsequent layers may be added. The final process is to fire the solar cells in a rapid thermal process up to 780 to 900 degrees Celsius by using infrared lamps. The company’s innovative PVD product line combines drying and firing in one furnace and closed loop convection cooling with precise temperature control to reduce waste. The anti reflective coating process enhances light entrapment in the solar cell. The company’s technologies operate at atmospheric pressure, which lowers production costs, increases up-time and lowers maintenance costs. One of two different processes can be configured using either titanium dioxide or silicon nitride for the coating.

BTUI will introduce products in 2008 to address thin film solar cell technology. The highest growth segment for PV products is the thin film segment. Thin film solar products incorporate solar cell technology with other materials such as roof shingles and sky-scraper windows. Thin film PV products represent 12% of the total market after growing 121% in 2007, according to Solarbuzz, and are expected to outpace the market growth with 45% annual growth through 2013. New technologies, such as nanostructured thin films and silicon and dyesensitized solar cells represented 0.5% of the 2007 PV market and are expected to grow at a 34% to 50% annual rate through 2013.

There are no manufacturing standards for thin film solar products. Consequently, high-end equipment suppliers such as BTUI do not have standard products to address the various requirements of thin film manufacturers. The company is working with leading developers on manufacturing process designs for thin film applications, and has adapted its technology to create its initial thin film furnace product. Some of the more promising thin film technologies utilize cadmium and telluride on glass, or CdTe, known as “CadTel.” The CadTel market is quickly moving towards high volume production, and the company plans to have one or two new products to address this market towards the end of 2008 or early 2009. Another promising thin film technology known as CIGS uses copper, indium, gallium and diselenide. The CIGS segment of the industry is in the process of moving from the research lab to pilot manufacturing. BTUI has made custom equipment for the CIGS market and is currently working with two technology leaders in the space.

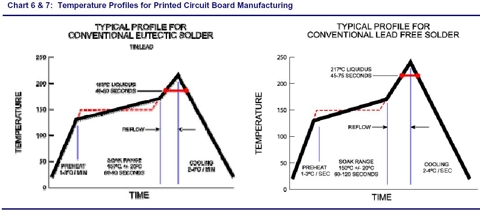

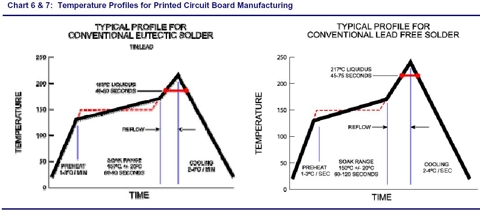

BTUI is a technology leader in PCB manufacturing. Temperature requirements for PCB manufacturing are precise and vary based on the electronic components and the soldering material used for the connection. The Pyramax product line can be configured to customer requirements for surface mount technology (SMT) applications in manufacturing printed circuit boards. SMT reflow furnaces typically use forced convection with air or nitrogen as the process gas. Lead free solders require higher temperatures and more precise timing due to maximum component temperature ratings. Both eutectic solder (metal mixture to lower melt point) and lead free solder has four phases: preheat, soak, reflow and cooling. The following charts outline the temperature control parameters achieved by the company’s Pyramax product line used in printed circuit board manufacturing.

In November, 2007, BTUI received the Global Technology Award from Global SMT & Packaging Magazine for its latest Pyramax Solder Reflow System. The new Pyramax product line enables improved process control with eight zones in the heating section and reduced nitrogen and power consumption.

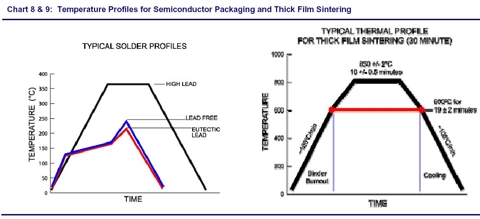

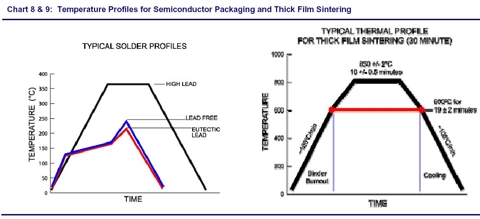

The company has leading technology for semiconductor packaging. A semiconductor package enables the chip to perform by feeding power to the integrated circuit [IC], drawing heat away and providing the data transfer mechanism. Given the variety of semiconductor applications from PC’s, mobile phones, TVs, iPods, PDAs, laptops, appliances and other electronic applications, there is also a variety of chip environments with different packaging requirements. The semiconductor packaging process often requires reflowing one solder type without impacting other solder, requiring precise temperature uniformity. A pure nitrogen environment is required to prevent oxidation of a solder joint. The Pyramax product line, TCAS, and wafer handler products serve the semiconductor packaging market.

Specialty applications leadership. Applications including microelectronics packaging, automotive electronics, resistive heaters and passive circuit applications require thick film metallization to construct electrical circuits on ceramic or metal substrates. A series of metal traces and up to 35 layers are created on the substrate using a sintering and drying process (thick film sintering). The company’s Fast Fire products serve this market.

Nuclear business is lumpy but very profitable. The company is the only provider of large scale processing furnaces for the nuclear fuel market. The Walking Beam product line processes nuclear fuel using temperatures up to 2,000 degrees Celsius. There are only “10 to 12 customers” worldwide that make uranium oxide fuel for nuclear reactors. This business is lumpy and typically contributes up to $4 million in revenues per year. Although the order cycle is very long, the company cites plans for 30 new reactors in Asia and Europe. Demand is driven by new plants requiring processed nuclear fuel, existing plants increasing capacity, and replacement of old equipment. Competitors in this niche market have smaller equipment with lower capacity and higher net costs for producing nuclear fuel, according to the company.

BTUI is working with fuel cell manufacturers. Manufacturing solid oxide fuel cells requires precision control of temperature and atmosphere for sintering. Fuel cells are not currently mass produced, thus, this market is in a research and development phase. BTUI currently works with Rolls Royce on its fuel cell technology, and has designed and built custom equipment for manufacturing solid oxide fuel cells.

Worldwide market presence. The company’s has two manufacturing facilities, in Billerica, Massachusetts and in Shanghai, China. The Massachusetts facility is used for highly complex products such as those for the nuclear market and custom products. The Shanghai China facility is designed for high volume production of standardized products. After opening the Shanghai facility in 2004, manufacturing costs decreased and gross margins improved significantly, itemized below. The company plans on transitioning more of its solar manufacturing from Billerica to Shanghai to further improve margins.

The majority of PV manufacturing has moved to China and other Asian countries to lower manufacturing costs. This trend is similar to the migration of PCB manufacturing to Asia in the past few decades. With the high concentration of solar cell manufacturers in Asia and China, it is important to have service capabilities in the region. The company’s engineering and manufacturing presence in China enables the company to service Electronics and Alternative Energy clients throughout Asia.

In March, 2008, BTUI opened a lab in Shanghai for customers to test PCB and solar cell manufacturing processes. Customers can develop custom processes with the assistance and expertise of BTUI engineers. The company plans on opening a similar lab facility for customers in Massachusetts in Q3:08.

BTUI has a strategic partnership with DEK. The company partnered with DEK, a division of Dover Corp., in August 2007, to better address the solar market. DEK manufactures screen printers, a component of the metallization process in solar cell manufacturing. The partnership combines BTUI’s high performance drying and firing technologies with DEK’s printing technologies to offer complete in-line metallization process solutions to silicon solar cell manufacturers. Both companies are technology leaders in their respective niches. The partnership effectively expands the company’s ability to participate in more solar cell manufacturing facilities.

Competition. The company cites two competitors that are public companies, Centrotherm in Germany, and Amtech in Arizona. Centrotherm is a market share leader in solar due to German subsidies that encourage solar energy. Centrotherm serves the solar and electronics markets and has a strong market share in Europe, but does not have a manufacturing presence in Asia. As a result, Centrotherm equipment prices are relatively high and ongoing maintenance expenses are also higher than that for BTUI products, according to the company. Amtech has a strong market share in electronics, and also has solar cell products. Amtech only makes batch furnaces and does not make products for in-line continuous process manufacturing. Two private firms in the US that manufacture in-line systems for the electronics and solar markets are Despatch and SierraTherm. Neither of these two companies has an Asian manufacturing facility, and both use third parties to service clients in Asia. BTU International’s manufacturing, research, engineering and service presence in China is a strong competitive advantage since the region has a high concentration of solar cell and PCB manufacturers. Lower manufacturing costs in China leads to attractive price points for the company’s products. Proximity to end users provides engineering expertise and timely service directly to customers.

Internally developed and acquired technology is patented. The company’s products have many patents for specific processes that occur within the furnace products. The Walking Beam product line for the nuclear fuel market has several patents. The gas barrier technology utilized in many of the furnace products, which is required for safety and purity of the gas, is patented.

The company has acquired technology and patents through two acquisitions in 2006. In June, 2006, the company acquired AtmoPlas™ technology from Dana Corp. The AtmosPlas process creates heat with the use of microwave energy to create a plasma (a highly ionized gas) at atmospheric pressure, where conventional technology requires a vacuum or very low pressure. The company is pursuing the application of this technology in new products. In February, 2006, the company acquired Radiant Technology Corp., a supplier of near infrared furnaces and dryers used primarily in the solar panel industry. The company uses infrared heating in its metallization furnaces.

Alternative Energy revenues doubled in FY:07, and should continue 100% growth rate. Revenues from Alternative Energy products doubled in 2007 and represented 21% of total revenues, up from 11% in 2006. Growth in solar panel manufacturing is driving Alternative Energy growth due to capacity expansion at existing PV manufacturers along with new contract manufacturers of silicon solar cells. We expect this growth trend to continue in 2008 and 2009 due to the manufacturing cost savings achieved with in-line processing, new opportunities in thin film applications and growing demand for solar panels worldwide.

Weak market for Electronics in 2007 is showing signs of rebounding. Capital spending from PCB manufacturers drives the company’s Electronic segment revenues. In 2007, Electronic segment revenues declined approximately 28%, due to the ramp up of adopting lead-free solder in 2006, which pushed normalized 2007 sales into 2006. Although the company does not report segment revenues, we estimate Electronic segmentrevenues declined slightly in Q1:08. BTUI reported strength in Electronic orders in Q1:08, and Q2:08 guidance reflects small growth for the Electronics business.

Gross margins are expanding. The company’s gross margins have expanded from 24% in 2004 to 43% in 2007, primarily due to the manufacturing and engineering center in Shanghai, China that opened in 2004. Gross margins for Electronics products are in the mid to upper 30% range, while solar products are in the 40% to mid 40% range. We expect the company’s gross margins will remain strong as revenue growth is driven by solar cell products.

Expenses rise as company invests in solar products. The company’s expansion into solar products has caused SG&A and R&D expenses to increase. While revenues declined 4% from 2005 through 2007, SG&A and R&D increased 23.9% and 76.3%, respectively. The new manufacturing, research and engineering center in Shanghai along with additional marketing personnel has driven the expense increase. The company plans to hire additional research, engineering and marketing personnel for the Alternative Energy business, primarily for the high growth solar area. We expect expense growth will be more closely aligned with revenue growth in the next year.

Strong balance sheet with $26.7 million in cash. The company has a low debt/equity ratio of 18.4%, with a mortgage on the Billerica facility as the only long term debt. Receivables increased in Q1:08 with DSO at 110.8 days versus 92.8 days in Q4:07. Annualized inventory turns was 2.3x in Q1:08. Receivables are relatively high and inventory turns below that for Amtech, the only competitor with publicly available GAAP data. Despite investments in solar business expansion, the company generated $1.5 million in operating cash in Q1:08, and reported $26.7 million in cash. We expect working capital management will steadily improve with the implementation of a new worldwide enterprise information system.

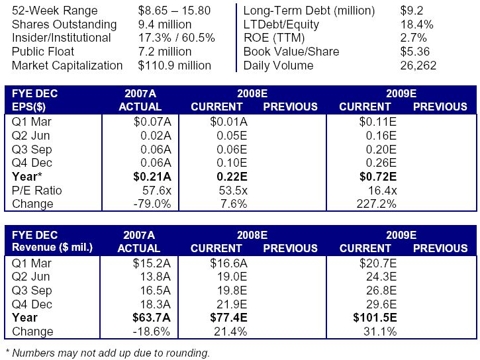

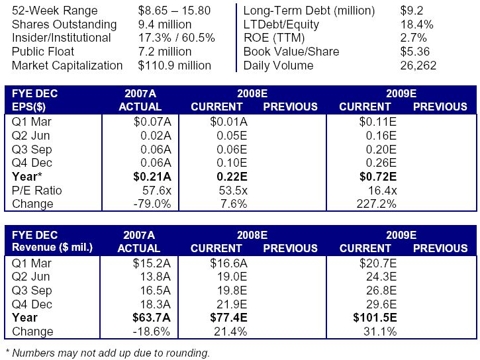

Guidance and estimates. Company guidance is for strong revenue contribution from solar panel manufacturers, with up to 100% growth in solar for 2008 and 2009. Guidance for the Electronics business is for a weak 2008, but long term growth of 5 – 7%. Management noted better than expected orders for the Electronics business at the end of Q1:08, and is guiding for revenues of $19 – 20 million in Q2:08 with EPS of $0.06 – 0.09.

We expect 2008 revenues to grow 21.4% to $77.4 million driven by 100% growth in the solar market and offset by a flat electronics market. We estimate the Alternative Energy business will contribute 34.7% of revenues in 2008, up from 21% in 2007. We expect the company’s solar business to grow faster than the estimated 30% industry growth due to the adoption of in-line manufacturing processes at existing solar cell manufacturers, and the company’s worldwide service capabilities. According to Solarbuzz, 41% of worldwide silicon solar cell manufacturing is in China, and the Chinese solar cell production capacity is expected to double in 2008. We believe the company is well positioned technologically and geographically to be a major participant in the strong solar cell manufacturing growth in China. The company’s technological expertise in new thin film solar cell applications will drive market share in this high growth sub-segment of the solar industry. We expect the Electronics business will be flat in 2008 and return to a normalized growth rate of 5 – 7% in the next few years. We do not expect the company to exit the Electronics business, since its manufacturing, engineering and service infrastructure along with its cash generating capacity supports growth in solar.

We estimate gross margin will improve throughout 2008 from the 39.9% in Q1:08 and average 41.4% for the year. We expect SG&A expense will increase 14.2%, and as a percent of revenues, SG&A will decline from 29.8% in 2007 to 28.1% in 2008. We estimate R&D expenses will increase 21.9% in 2008. Our EPS forecast for 2008 is $0.22, an increase of 7.6%.

Our revenue forecast for 2009 is for 31.1% growth to $101.5 million. We expect solar product revenues will increase 85%, driven by increasing adoption of in-line processing, demand for silicon solar panels and growing demand for thin film solar products. Our revenue forecast incorporates low single digit growth for electronics products in 2009. We forecast gross margins will improve to 42.5%, driven by the higher margins in solar products. We expect SG&A expense as a percent of revenues to decline to 24.7% in 2009. Our 2009 EPS forecast is $0.72, an increase of 227.2%

INVESTMENT RISKS

Company is exposed to capital spending cycles. The company’s revenues depend on capital spending from electronics semiconductor manufacturers, PCB manufacturers and solar panel manufacturers. The electronics semiconductor and PCB manufacturing markets have historically been cyclical. Although it appears the low point of the cycle was reached in 2007 when revenues from electronics customers declined 30%, there can be no assurance the bottom of the cycle was reached or when any subsequent cyclical recovery may occur. Management expects long term growth of 5 – 7% in Electronics.

Growth in Solar Panel demand may not meet industry forecasts. The projected industry growth rate of 30% according to Solarbuzz and BCC Research may not occur. Although the high price of oil tends to increase demand for adopting solar energy solutions, growth in solar energy demand may be higher or lower than current industry forecasts.

Solar panel manufacturers may not shift to in-line processing. A significant component of our revenue growth assumptions is based on the adoption of in-line process manufacturing by existing silicon solar manufacturers. Existing solar panel manufacturers may not adopt in-line processing as quickly as we expect.

Solar panel demand is partly dependent on government subsidies. Current government subsidies to install solar panels may not continue. Although we doubt subsidies to reduce dependence on fossil fuels by encouraging use of renewable energy will decline, it may occur.

Increasing globalization of company creates management difficulties. The company expanded its global imprint with the opening of the Shanghai manufacturing and engineering facility. The growth in solar products will cause the Shanghai facility to increase in importance for the company. Any political or economic instability in the Asia Pacific region could have a negative effect on the company’s operations in Shanghai. Coordinating production, supply, delivery, and marketing from two locations half a world apart, creates additional management issues, particularly for a small company. BTUI has experience managing its manufacturing operations in Shanghai since 2004, and has served customers in the Asia Pacific region for a number of years.

The company’s competitive product position may be altered by a new competitor or improved products from existing competitors. The company currently competes on product quality, price and service. The company’s engineering and customer testing facility in China is close to the majority of PCB and solar panel manufacturers. Competitors may duplicate the company’s geographic footprint, or create superior products.

The company’s new products for thin film solar cell manufacturing may not be competitive. The company plans to introduce one or two new products for thin film solar cells in late 2008 ore early 2009. Although BTUI has been working with two leading thin film manufacturers on designing these new furnaces, other thin film manufacturing processes may become the standard for thin film production in the next few years. The company may need to redesign its new product offerings if this occurs.

VALUATION

BTUI International trades at 53.5x our 2008 EPS estimate of $0.22, 16.4x our 2009 estimate of $0.72, at 1.7x TTM revenues, 25.1x EV/EBITDA and 2.2x book value. Due to our confidence in projecting future cash flows for the company, we value the company on a DCF basis. The company’s ROC in 2007 was 3.6%, down from 10.3% in 2006, due to weakness in the Electronics business. As the Alternative Energy business grows, and the Electronics business rebounds from a cyclical low, we expect ROC to steadily improve. We forecast ROC of 4.1% in 2008, and 9.7% in 2009. We expect ROC will average 11% in 2010 and beyond. The reinvestment rate in the TTM period was 192% due to the investments in the Alternative Energy business. We expect the reinvestment rate to remain close to 200% for 2008 and 2009, and average 63.2% in 2010 and beyond. We expect the operating margin will increase in 2008 to 4.4%, from 4.3% in 2007, and increase to 10.8% in 2009 as the solar revenue contribution grows. Our assumptions lead to a price target of $20.00.

As the table above shows, the necessary combinations of assumptions for ROC and discount rates required to find BTU International overvalued seem unrealistic.

The table above shows how current PE multiples based on our earnings estimates of $0.72 for 2009 are low given strong worldwide demand for solar panels, and lower cost per watt for solar panels by implementing in-line processes. We expect the multiple to move higher as investors recognize the company’s strong competitive position in a growth industry. Given the upside projected by our price target, we rate the shares BUY.