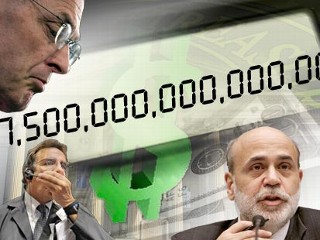

The government's financial bailout will be the most expensive single expenditure in American history, potentially costing around $7.5 trillion -- or half the value of all the goods and services produced in the United States last year.

In comparison, the total U.S. cost of World War II adjusted for inflation was $3.6 trillion. The bailout will cost more than the total combined costs in today's dollars of the Marshall Plan, the Louisiana Purchase, the Korean War, the Vietnam War and the entire historical budget of NASA, including the moon landing, according to data compiled by Bianco Research.

It remains to be seen whether the government's multipronged approach to bail out banks, stimulate spending and buy up mortgages will revive the economy, but as the tab continues to grow so does concern over where the government will find the money.

Monday the government guaranteed an additional $306 billion to bail out Citigroup, and today Treasury Secretary Henry Paulson pledged $800 billion to make credit more available to consumers and small businesses, and to buy up mortgages from Fannie Mae and Freddie Mac.

Congress last month allocated $700 billion for an emergency bailout of some of Wall Street's most storied firms by purchasing their troubled assets. The funds allocated through the Troubled Assets Relief Program are but a small part of the government's overall bailout spending.

Bailout programs also include a Federal Reserve plan to buy as much as $2.4 trillion in short-term notes called commercial paper that began Oct. 27, and an FDIC plan to spend $1.4 trillion to guarantee bank-to-bank loans that commenced Oct. 14, according to Bloomberg News, which first compiled the total cost of the bailout.

In March, the government spent $29 billion to help JPMorgan Chase take over Bear Stearns and allocated $122.8 billion in addition to TARP to bail out AIG, once the world's largest insurance company.

"No one really knows if any of this is going to work," said Barry Rithotlz, CEO of Fusion IQ, an online quantitative research firm and author of "Bailout Nation."

"All of these different things are going to have a limited impact, and it remains to be seen which if any of them will resolve anything. Paulson today pledged $600 billion to buy debt backed by government chartered Freddie Mac and Fannie Mae. That will put more money into the system, but so far we haven't see a tremendous response to mortgage rates."

The federal government today announced two new plans, allocating a combined total of $800 billion to help stimulate the economy by making credit more easily available to consumers, a move Paulson called vital to strengthening the economy.

"Millions of Americans cannot find affordable financing for their basic credit needs. And credit card rates are climbing, making it more expensive for families to finance everyday purchases," Paulson said. "This lack of affordable consumer credit undermines consumer spending; as a result, it weakens our economy."

Paulson said $200 billion would be allocated from the remaining $350 billion in TARP to banks to back things like student loans, auto loans and credit cards in the hopes that small business and consumers, who were virtually frozen out of the credit market last month, can recommence spending.

An additional $600 billion, not included in the original TARP bailout, would be used to buy mortgages -- $100 billion purchased directly form Fannie Mae and Freddie Mac, and $500 billion spent on mortgage-backed securities, pools of mortgages that are bundled together and sold to investors.

Paulson said today's newest initiatives were small pieces of an historic program, and that there was no one solution the government could implement to rescue the economy.

"It is naive for any of us to think that when you are dealing with a situation of this magnitude that a bill could be passed or a single action taken to make all the issues go away," he said. Paulson didn't specifically say where the government would get the money from, but it would likely print more dollars and borrow in the Treasury markets.

"It's a combination of things," said Ritholtz. "They'll print money and inflate our way out of the current situation -- essentially devalue the dollar, print more dollar bills and print more notes."

Economist Joel Narroff said the government would likely borrow the money.

"The government will borrow, essentially run up the debt. We're looking at a deficit in the trillions of dollars. We'll worry about the deficit later. At this point, Paulson is saying, 'Where are the fires, and trying to pour water on them as much as possible,'" he said.

Paulson must go to Congress to get the second $350 billion remaining in TARP, $200 billion of which was pledged to asset-backed securities such as student and car loans.

Paulson said there was no timeline for going back to Congress, but that the $200 billion was "a starting point."

Under TARP, the secretary is required to return to Congress to receive the second half of the program's total allotment of $700 billion.

Of the first half, some $290 billion had already been allocated. The first TARP tranche of $158 billion was dispersed on Oct. 28 to nine banks: Bank of America, Bank of New York Mellon Corp., Citigroup (thought it later received more money), Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street Corp., Wells Fargo and Merrill Lynch.

An additional $91 billion was allocated Nov. 14, leaving some $60 billion unallocated.

No comments:

Post a Comment