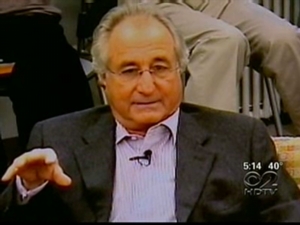

Play Video CBS 2 New York – Charities Among Hardest Hit In Madoff Fraud

Play Video CBS 2 New York – Charities Among Hardest Hit In Madoff FraudWASHINGTON – The fraud investigation of Wall Street money manager Bernard L. Madoff took unusual twists Wednesday as the U.S. attorney general removed himself and the Securities and Exchange Commission looked into the relationship between Madoff's niece and a former SEC attorney who reviewed Madoff's business.

The developments reflect growing criticism that Wall Street and regulators in Washington have grown too close. Madoff himself has boasted of his ties to the SEC.

The question of Madoff's connection to regulators goes to the heart of the investigation of the alleged $50 billion fraud, SEC Chairman Christopher Cox told reporters.

Congress jumped into the Madoff scandal, too. The chairman of the House capital markets subcommittee, Rep. Paul Kanjorski, D-Pa., announced an inquiry that will begin early next month into what may be the biggest Ponzi scheme of all time and how the government failed to detect it.

In New York, Madoff showed up at the federal courthouse to sign some papers in his case, wearing a baseball cap and walking silently past a reporter who asked Madoff whether he had anything to say to his alleged victims. Free on $10 million bail, Madoff now has a curfew and an ankle-bracelet to monitor his movements.

U.S. Attorney General Michael Mukasey recused himself from the Madoff probe because his son, Marc Mukasey, is representing Frank DiPascali, a top financial officer at Madoff's investment firm. The Justice Department refused to say when Mukasey became aware of the conflict but confirmed Wednesday he was removing himself from all aspects of the case.

DiPascali was the Madoff employee who had the most day-to-day contact with the firm's investors. Several described him as the man they reached by phone when they had questions about the firm's investment strategy, or wanted to add or subtract money from their accounts.

The turmoil at the SEC came as the investigation into the scandal widened.

Massachusetts Secretary of State William Galvin's office said he subpoenaed Madoff's brother, Peter Madoff, who is the chief compliance officer of Madoff's company, and Marcia Beth Cohn, chief compliance officer of Cohmad Securities Corp., which is in the same building in New York. Galvin is trying to determine the relationship between Madoff's firm and Cohmad Securities, as well as the names and numbers of all Massachusetts investors with both companies.

The events unfolded the day after Cox delivered a stunning rebuke to his own career staff, blaming them for a decade-long failure to investigate Madoff.

Credible and specific allegations regarding Madoff's financial wrongdoing going back to at least 1999 were repeatedly brought to the attention of SEC staff, said Cox. Cox said he was gravely concerned by the apparent multiple failures over at least a decade to thoroughly investigate the allegations or at any point to seek formal authority from the politically appointed commission to pursue them.

Cox's critics said that targeting the staff was Cox's attempt to salvage his own reputation.

"He put in place the people he is now shifting the blame to," said Ross Albert, a former SEC senior special counsel, former federal prosecutor and now a private attorney in Atlanta.

Senate Majority Leader Harry Reid, D-Nev., suggested Cox bears some of the responsibility for what went wrong.

"I served in Congress with Christopher Cox, but I don't think he's going to make the All-Star team," said Reid.

SEC Inspector General David Kotz is looking into the agency's failure to uncover the alleged fraud in Madoff's operation. One area Kotz said he will examine is the relationship between a former SEC attorney, Eric Swanson, and Madoff's niece, Shana, who are now married.

As an SEC attorney, Swanson was part of a team that examined Madoff's securities brokerage operation in 1999 and 2004. Neither review resulted in any action against Madoff. In a statement about Swanson's role, the SEC compliance office cited its strict rules prohibiting employees from participating in cases involving firms where they have a personal interest.

A spokesman for Swanson said that he and Shana Madoff met at a breakfast in October 2003, started dating in April 2006 and married last year.

Kotz said his office would move as quickly as possible to complete the inquiry into why regulators didn't pursue Madoff more aggressively.

Kanjorski, the lawmaker, said his subcommittee's inquiry will examine the alleged Madoff fraud and try to determine why the SEC and other regulators "failed to detect these substantial evasions."

With the scandal swirling around Madoff, he was unable to find co-signers of his bail package. The judge modified the bail package, and gave lawyers until next Monday to come up with additional paperwork.

No comments:

Post a Comment